does instacart automatically take out taxes

Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. This is a standard tax form for contract workers.

All You Need To Know About Instacart 1099 Taxes

The Instacart 1099 tax forms youll need to file.

. Everyone out there serving for. As an independent contractor you must pay taxes on your Instacart earnings. Bestreferral Team April 16 2022 Reading Time.

Knowing how much to pay is just the first step. They do not automatically take out taxes. As an independent contractor you must pay taxes on your Instacart earnings.

Do Instacart and Shipt take out taxes. Youll include the taxes on your Form 1040 due on April 15th. Instacart does not have a set minimum wage for its shoppers.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. Take photos of receipts and automatically log business miles.

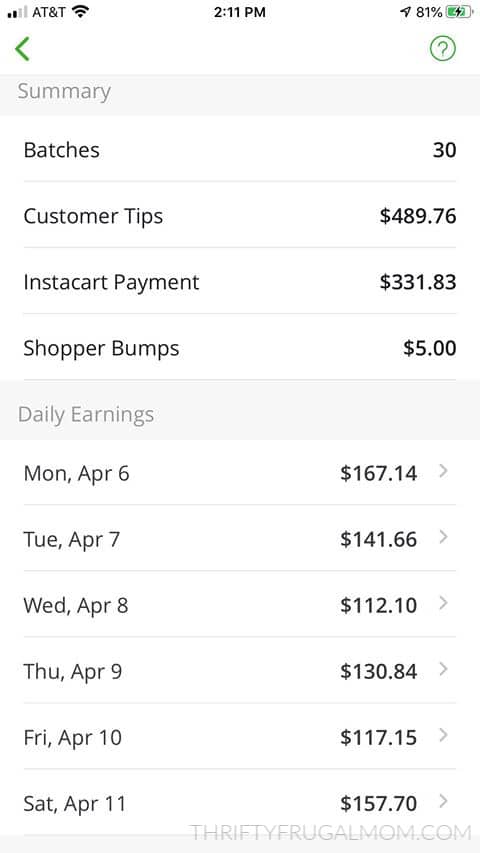

As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per hour. If taxes drive you crazy youre not alone. Figuring out how much tax to pay by the 4 deadlines could be a challenge if your income is variable.

Does Instacart Take Out Taxes. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

You can deduct tolls and parking. Does Instacart take out taxes for its employees. Answer 1 of 4.

Youll include the taxes on your Form. What Taxes Do Instacart Shoppers Need to Pay. For Instacart to send you a 1099.

The organization distributes no official information on temporary worker pay however they do. When youre ready to fill out your tax return you can. This includes self-employment taxes and income taxes.

Stride is a free app that makes it simple to find and track deductible business expenses take pictures of receipts and automatically record business mileage. Generally you cant use the free version to file self-employed tax forms. The rate for the 2022 tax year is 625 cents per mile for business use starting from July 1.

Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats. June 5 2019 247 PM. Ultimate Tax Filing Guide.

Whether you choose to work for. The Instacart 1099 tax forms youll need to file. To actually file your Instacart taxes youll need the right tax form.

If you had no tax liability at all last year you dont need to make estimated payments. Instacart delivery starts at 399 for same-day orders over 35. This can be discouraging.

Accurate time-based compensation for Instacart drivers is difficult to anticipate. There will be a clear indication of the delivery. How do I use the Stride app to help file my taxes.

Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them. Does Instacart take out taxes for its employees. The rate from January 1 to June 30 2022 is 585 cents per mile.

For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour.

How Much Do Instacart Shoppers Make 2021 Update Gridwise

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Ipo What You Need To Know Forbes Advisor

Instacart Driver Review 10k As A Part Time Instacart Shopper

Real Time Self Employment Tax Calculations Hurdlr

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

Instacart Taxes The Complete Guide For Shoppers Ridester Com

I Saved Money On Instacart Delivery With A Credit Card Promotion

Instacart Driver Review 10k As A Part Time Instacart Shopper

What You Need To Know About Instacart 1099 Taxes

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

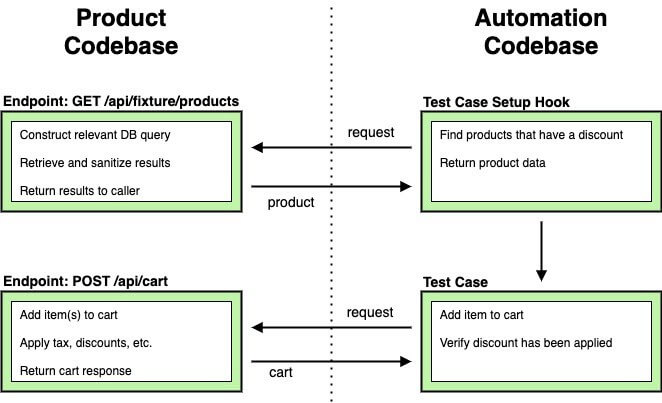

Understanding Software Quality At Scale

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

When Does Instacart Pay Me The Complete Guide For Gig Workers

Does Instacart Track Mileage The Ultimate Guide For Shoppers

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier